UAE VAT Calculator – Add or Remove 5% VAT Online

UAE VAT Calculator

Add or remove 5% VAT instantly based on UAE tax rules

VAT Calculation in UAE Explained – Step-by-Step Video Guide

Use our UAE VAT calculator to quickly add or remove 5% VAT from any amount. This simple online VAT calculator helps individuals, freelancers, and businesses calculate tax-inclusive or tax-exclusive values in seconds.

Whether you need a VAT tax calculator for invoices, pricing, or accounting, this tool provides fast and accurate results based on the standard 5% UAE VAT rate.

What Is a VAT Calculator?

A VAT calculator is a tool used to calculate Value Added Tax (VAT) on goods and services. It helps you:

- Add VAT to a base price

- Remove VAT from a total price

- Find the VAT amount

- Calculate tax-inclusive or tax-exclusive values

This tool works as a tax calculator, online VAT tax calculator, and calculator VAT online for everyday UAE use.

Many users search for:

- VAT calculator Dubai

- VAT tax calculator

- Online VAT calculator

- Tax & VAT calculator

All of these functions are covered by this page.

UAE VAT Rate

In the United Arab Emirates, the standard VAT rate is:

5% VAT

This VAT rate is followed uniformly throughout all emirates, including Dubai, Abu Dhabi, and Sharjah.

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Fujairah

- Ras Al Khaimah

- Umm Al Quwain

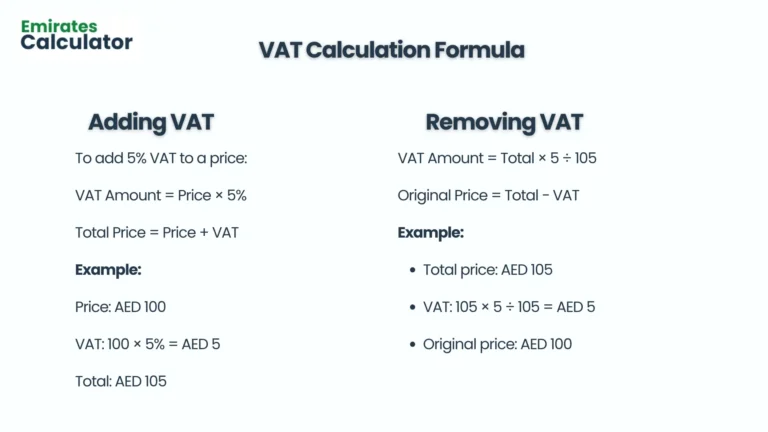

VAT Calculation Formula

Understanding the VAT calculation formula helps you verify results.

1. Adding VAT

To add 5% VAT to a price:

VAT Amount = Price × 5%

Total Price = Price + VAT

Example:

- Price: AED 100

- VAT: 100 × 5% = AED 5

- Total: AED 105

2. Removing VAT

To remove VAT or take off VAT from a total amount:

VAT Amount = Total × 5 ÷ 105

Original Price = Total − VAT

Example:

- Total price: AED 105

- VAT: 105 × 5 ÷ 105 = AED 5

- Original price: AED 100

This is the standard VAT amount formula used in UAE accounting.

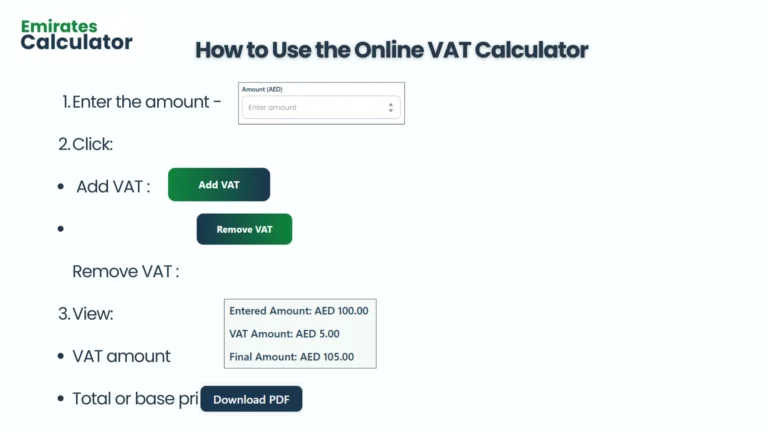

How to Use the Online VAT Calculator

- Enter the amount

- Click:

- Add VAT

- Remove VAT

- View:

- VAT amount

- Total or base price

- Download PDF :

This tool works as:

- Online VAT calculator

- VAT tax calculation formula checker

- Quick tax calculator for UAE pricing

Who Can Use This VAT Calculator?

This online VAT calculator is useful for:

- Small business owners

- Freelancers

- Shop owners

- Accountants

- Employees handling invoices

- Anyone needing quick tax calculations

VAT vs Income Tax in UAE

Some users search for:

- Income tax calculator

- Taxable income calculator

- Income and tax calculator

- Stamp duty calculator

However, it’s important to note:

- The UAE does not have personal income tax

- The standard tax applied to goods and services is 5% VAT

This page focuses specifically on VAT tax calculations in the UAE.

Common VAT Use Cases

You may need a VAT calculator when:

- Creating invoices

- Checking product prices

- Comparing tax-inclusive and tax-exclusive amounts

- Calculating business expenses

- Filing VAT returns

Frequently Asked Questions (FAQs)

What is the VAT rate in UAE?

The UAE follows a 5% VAT system, which is applied to most commercial goods and services unless specifically exempted.

How do I remove VAT from a price?

Use the remove VAT option in the calculator, or apply the formula:

VAT = Total × 5 ÷ 105

Can I use this as a tax calculator?

Yes. This tool works as a tax calculator for UAE VAT purposes.

Does UAE have income tax?

No. The UAE does not have personal income tax, so an income tax calculator is generally not required for individuals.

Important Note

This VAT calculator provides estimated results based on the standard UAE VAT rate. Actual tax amounts may vary depending on transaction type, exemptions, or regulatory changes.

Emirates Calculator Your UAE Calculator Platform

Emirates Calculator offers easy-to-use tools like the gratuity calculator UAE and zakat calculator to help users estimate end of service benefits, charitable obligations, and other essential UAE-related calculations quickly and accurately.