UAE Gratuity Calculator – End of Service Benefits Calculator 2026

UAE Gratuity Calculator 2026

Calculate your end of service benefits under UAE Labour Law

Gratuity Result

| Service Period | Daily Wage | Eligible Days | Gratuity (AED) |

|---|---|---|---|

| Total Gratuity | AED 0.00 | ||

How to Calculate Gratuity in UAE (Video Guide)

Emirates Calculator is a trusted UAE calculator platform offering easy-to-use tools such as salary calculators, UAE gratuity calculator, VAT calculators, prayer times, and other essential utilities designed for life in the United Arab Emirates.

Our End of Service Calculator UAE helps employees, expats, HR professionals, and business owners accurately estimate gratuity amounts as per UAE Labour Law. Whether you are working in Dubai, Abu Dhabi, Sharjah, Ajman, Ras Al Khaimah, Fujairah, or Umm Al Quwain, our calculator gives fast and reliable results.

Use our UAE gratuity calculator 2026 to instantly calculate your end-of-service benefits with updated formulas and clear breakdowns.

Understanding the UAE Online Gratuity Calculator

A UAE gratuity calculator is an online tool that helps employees determine their End-of-Service Benefits (EOSB) based on their basic salary, years of service, and employment contract type.

Instead of manually calculating complex formulas, our gratuity calculator Dubai and end of service calculator UAE instantly compute the amount you are legally entitled to receive when leaving a job in the UAE.

This calculator follows guidelines applicable across all emirates:

- Dubai

- Abu Dhabi

- Sharjah

- Ajman

- Ras Al Khaimah

- Fujairah

- Umm Al Quwain

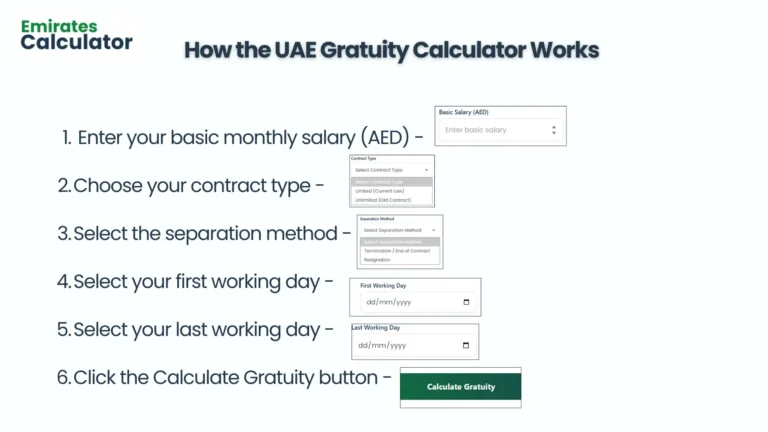

How the UAE Gratuity Calculator Works

The calculation process is simple and user-friendly:

- Enter your basic monthly salary (AED)

- Choose your contract type (Limited or Unlimited)

- Select the separation method (Resignation or Termination / End of Service)

- Select your first working day

- Select your last working day

- Click the Calculate Gratuity button to instantly view your estimated gratuity amount

This tool removes confusion and ensures accurate gratuity calculated in UAE conditions.

Advantages of Using a MOHRE-Based Gratuity Calculator

Using a gratuity calculator aligned with MOHRE standards offers multiple benefits:

- Accurate end-of-service calculations

- Time-saving and error-free results

- Transparent breakdown of gratuity components

- Applicable for all UAE emirates

- Updated for current labour law practices

This makes our end of service calculator Dubai and UAE-wide tools ideal for both employees and employers.

How End-of-Service Benefits Are Calculated in the UAE

Gratuity in the UAE is calculated based on the following factors when understanding how gratuity is calculated in the UAE:

- Basic salary only (excluding allowances)

- Total continuous years of service

- Type of employment contract

- Mode of job separation (resignation or termination)

Allowances such as housing, transport, overtime, and bonuses are not included in gratuity calculations.

Step-by-Step Process to Calculate End-of-Service Benefits

- Confirm your basic monthly salary

- Calculate your total service duration

- Apply the correct gratuity rate (21 or 30 days)

- Check if the maximum gratuity cap applies

- Arrive at the final EOSB amount

Our UAE gratuity calculator 2026 automates all these steps.

Employment Contract Types in the UAE

There are two main employment contract structures in the UAE:

- Limited (Fixed-Term) Contracts

- Unlimited (Open-Ended) Contracts

Each contract type can impact gratuity eligibility and final settlement outcomes.

Official UAE Gratuity Calculation Formula

For Employees with Less Than 5 Years of Service

Gratuity = (Basic Salary ÷ 30) × 21 × Years of Service

For Employees with More Than 5 Years of Service

Gratuity =

[(Basic Salary ÷ 30) × 21 × 5] +

[(Basic Salary ÷ 30) × 30 × Additional Years]

Maximum Gratuity Cap

Gratuity is limited to two years’ basic salary, regardless of total service duration.

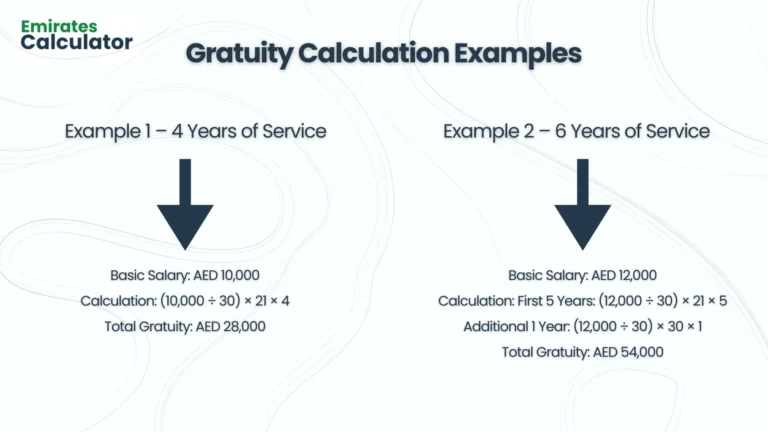

Gratuity Calculation Examples

Example 1 – 4 Years of Service

- Basic Salary: AED 10,000

- Calculation: (10,000 ÷ 30) × 21 × 4

- Total Gratuity: AED 28,000

Example 2 – 6 Years of Service

- Basic Salary: AED 12,000

- Calculation: First 5 Years: (12,000 ÷ 30) × 21 × 5

- Additional 1 Year: (12,000 ÷ 30) × 30 × 1

- Total Gratuity: AED 54,000

Use the calculator above for instant results.

Resignation vs Termination Gratuity Differences

Gratuity entitlement can differ depending on how employment ends:

- Resignation may affect eligibility in certain cases

- Termination generally ensures full gratuity unless misconduct applies

- Employer-initiated termination without legal cause still requires gratuity payment

Limited vs Unlimited Contract Comparison

| Aspect | Limited Contract | Unlimited Contract |

|---|---|---|

| Contract Duration | Fixed | Open-ended |

| Gratuity Rules | Standard EOSB | Standard EOSB |

| Early Exit Impact | May vary | More flexible |

The difference between limited and unlimited contracts in the UAE mainly relates to contract duration and flexibility. A limited contract has a fixed end date agreed between the employer and employee, while an unlimited contract is open-ended and continues until either party gives notice. In both cases, gratuity is calculated according to standard UAE labour law based on basic salary and years of service, but early resignation or termination terms may vary depending on the contract type.

Maximum Limit on Gratuity in UAE

UAE Labour Law caps gratuity at:

24 months of basic salary

Any amount beyond this limit is not payable

If Employers Fail to Pay Gratuity

If gratuity is not paid:

Employees can file a complaint with MOHRE

Employers may face legal penalties

Courts can enforce payment with fines or sanctions

Calculating Final Settlement in the UAE

Final settlement includes:

Gratuity

Unpaid salary

Leave encashment

Pending benefits or reimbursements

Our calculator focuses on gratuity, but understanding the full settlement helps financial planning.

Gratuity for Domestic Workers in the UAE

Domestic workers may have separate rules based on contract terms and specific regulations. It is recommended to review employment agreements carefully before calculation.

Gratuity vs Tip – Key Differences

Gratuity (EOSB): Legal end-of-service benefit

Tip: Voluntary payment for service

Gratuity is mandatory; tips are optional

Common Gratuity Calculation Mistakes

Including allowances in basic salary

Ignoring service duration accuracy

Misunderstanding contract type

Not applying the gratuity cap

Relying on outdated formulas

Frequently Asked Questions (FAQs)

Is gratuity calculated on gross salary?

No, gratuity is calculated only on basic salary.

Does gratuity apply across all emirates?

Yes, the same rules apply in Dubai, Abu Dhabi, Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain.

Is gratuity taxable in the UAE?

No, gratuity is currently tax-free.

Can I calculate gratuity online?

Yes, use our end of service calculator UAE for instant results.

Emirates Calculator Your UAE Calculator Platform

After estimating your end-of-service benefits, you can also use our VAT calculator UAE to quickly add or remove 5% VAT from any amount, or try our Zakat calculator UAE to estimate your charitable obligation based on your savings and assets.